Webloyalty today continues to uncover the truth behind where the retail industry is heading. Last week’s blog was retail expenditure and the future of retail, and this week looks at retail spending and its associated growth rates. Presented in the recent report, Webloyalty: The future of retail, this is what is predicted for the upcoming years:

Click on the image to view a larger version.

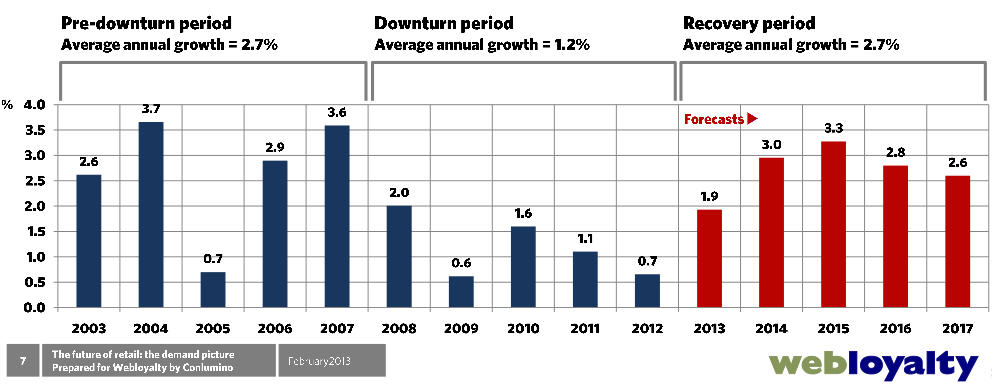

This Webloyalty research suggests that retail growth will recover, but this will be driven primarily by inflation. The chart above shows the total growth rates from 2003-2012 and also predicts what growth rates will be seen up to 2017. What stands out from this chart is the impact that the downturn has had on the retail sector. Since 2008, compared to the previous year, the average growth has only been 1% per annum. This compares unfavourably with the pre-recession growth levels that averaged approx. 3.1%.

View & download the full research: www.webloyalty.co.uk/research

The downturn has cost retail

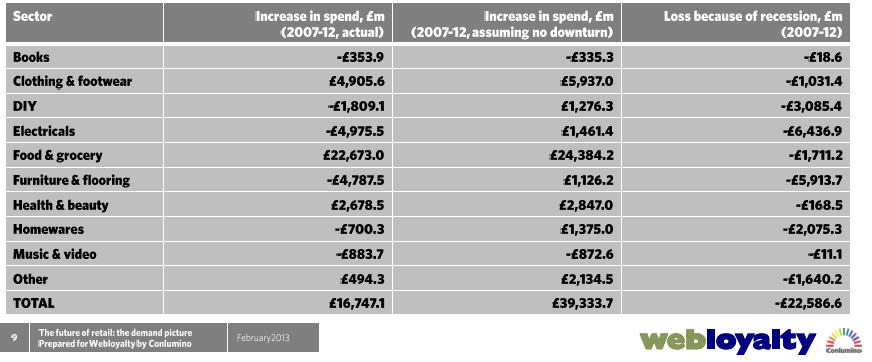

Over the past five years, the downturn has cost retail £22.6bn (this is the average growth value). The table below shows specific insights into how each sector within retail has performed as a result of the recession. Click on the image to view a larger version. The first column of the table shows the increase or decrease in spend across various sectors from 2007 to 2012. The second column shows the calculations of how much each sector has grown by, assuming there wasn’t a downturn. This research shows that ‘need and treat’ based sectors, such as food and grocery, have seen increased spend, followed by clothing and footwear. The sectors that made an overall loss are books, music and videos.

The first column of the table shows the increase or decrease in spend across various sectors from 2007 to 2012. The second column shows the calculations of how much each sector has grown by, assuming there wasn’t a downturn. This research shows that ‘need and treat’ based sectors, such as food and grocery, have seen increased spend, followed by clothing and footwear. The sectors that made an overall loss are books, music and videos.

The forecast looks positive

According to this Webloyalty research, the future however does look more positive. Retail is expected to grow between 2013 and 2017, with average growth rates of 2.7% per year. Inflation needs to be taken into account as the underlying volume growth rate will remain lower than the period just before the downturn.