When asked what tools they use to make purchase decisions, UK consumers put online research (57%), word of mouth from friends (56%) and personal experience (51%) at the very top of the list, according to Webloyalty’s report, The Unfaithful Consumer. So why are retailers still spending 50% of their marketing budget, which reached £15.8 billion in 2015, on television, print, outdoor, radio and cinema advertisements?

Preferences shifting rapidly

In 2015, for the first time ever, money spent on digital advertising in the UK matched spending on more traditional forms such as television or print advertising. The UK is in fact a trendsetter in this regard since globally and in the US, television advertising remains king, garnering around 40% of all money spent. This clearly shows UK shoppers want to be courted by retailers differently.

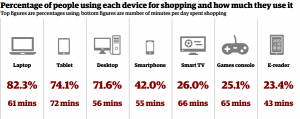

This is probably due in part to the increasing amount of time UK consumers spend using and shopping with digital devices. According to Webloyalty’s The Connected Consumer report, people now use their tablet for 72 minutes a day, while they use their laptop and desktop computers for 61 and 56 minutes respectively.

The significant amount of time consumers spend away from traditional media means the money retailers allocate to television or print advertising, for example, is becoming less and less efficient.

This means, UK retailers must rethink the way they try to reach potential customers. One area that keeps gaining momentum is social media.

The benefits of being social

Advice from friends plays a role in 56% of UK consumers’ purchasing decisions, says The Unfaithful Consumer. Considering “37% of online shoppers post their recommendations and reviews to their friends and social network connections about what they bought,” this makes social media particularly effective as a marketing tool.

Facebook commands the most influence, according to DigitasLBi’s Connected Commerce study, “with more than half (52%) of users now admitting that the social network impacts the way they shop, up from 36% in 2014. This compares to 46% for Pinterest, 43% for Instagram and 36% for Twitter.”

This is especially true when “targeting specific customer groups,” says The Unfaithful Consumer, and “it should gradually take a rising share of total advertising spend at the expense of more traditional mass market” options.

In its Top 5 list of reasons why retailers should invest in Facebook advertisements, Statement, a digital agency, argues that the social media platform is a great way to reach people by location, gender, age, interests, relationship status, workplace or education.

“Whilst casting a net and reaching a wide range of audiences is good, it can be more valuable to reach a smaller amount of people who are most likely to buy from you in the future.”

Looking at the marketing budget of the largest retailers in the world is also a good way to define new priorities and the results show that search engines are still very popular.

Searches still a clear path to purchases

In 2014-2015, Amazon spent $8 million (£6.5 million) on television and radio, and $54 million (£41 million) on print advertising, according to a study by content marketing agency Fractl. In comparison, the ecommerce giant spent $1.35 billion (£1.1 billion), or 91% of its overall budget, on search. Apple, another brand heavily supported by advertising, spent 86% of its budget on search during the same period.

This is significant since “personal research conducted online” is the top most used tool (57%) by UK consumers to help them decide where to shop, according to The Unfaithful Consumer.

Another benefit of banking on search is that it forces retailers to think harder about the content they put on the Internet in order to “appeal to users and boost their SEO,” explains Fractl project manager, Lillian Podlog.

Perhaps even more important is the correlation found between the amount a retailer spends on search campaigns, as opposed to digital, and their ranking in Google’s top 100 organic search results.

This means not all digital marketing produces the same results and retailers should be careful where they spend their digital advertising budget. After all, many consumers now use ad blockers or have become immune to online advertisements.

Understanding how consumers make shopping decisions and meeting them where it matters is key to increase the efficiency of marketing budgets. Retailers “need to re-evaluate how to reach customers and reappraise traditional marketing techniques – many of which are still relevant, but are less impactful and influential in today’s environment,” concludes Guy Chiswick of Webloyalty. “This deeper understanding will ultimately help retailers secure loyalty in the era of the unfaithful consumer.”