What is happening to the world of eCommerce?

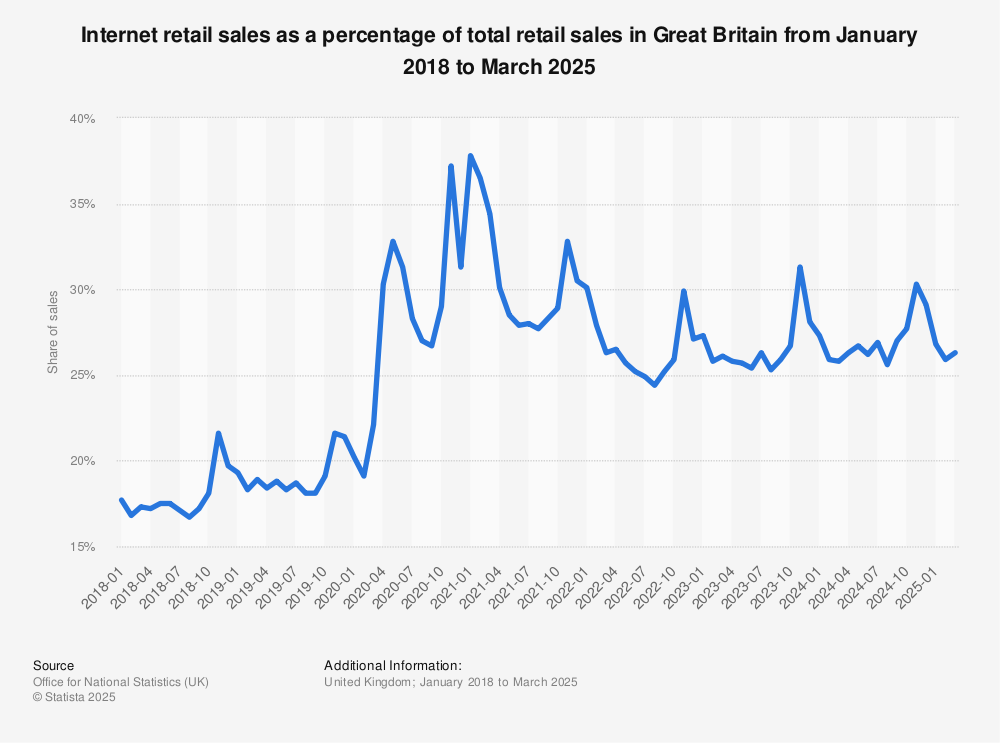

eCommerce has undergone a turbulent couple of years but there was a significant change with it being one of the few industries that were advantageous during the pandemic. Prior to COVID-19, eCommerce contributed to just below 20% of retail sales but that figure vastly increased in the past two years. As more and more shoppers switched to an online shopping experience due to the closures of in-person stores and the need for stores to have a digital presence, eCommerce was responsible for over 1/3rd of total retail sales between November 2020 and January 2021.

However, that boom was short-lived as the overall percentage declined by the end of 2021 as the world was beginning to recover from the pandemic. Now, in 2022, eCommerce has stabilised around the 27% mark.

What does this mean for eCommerce profitability?

The adaptation of online shopping has many perks for the consumer. It’s the luxury of being able to shop online from virtually anywhere with an internet connection and receive orders directly to your door, without having to leave the house. Choosing online discounts and selecting specific delivery dates and times means shopping online starts to outweigh the advantages of shopping in store. Yet, the benefits of online shopping for shoppers correlates with a loss for the retail sector. It is estimated retail will lose £8bn in profits due to the transition to more online shopping, making the estimated pre-tax profit decline from 5.5% to 3.2%. But exactly why is this happening?

There are numerous factors contributing to tight eCommerce margins. Here are a few that are heavily affecting the industry.

Free Returns

It’s become a staple of online shopping, especially the apparel sector, to offer customers free returns on their orders. Unlike brick-and-mortar stores, the ability to try on clothes is not available which has led to a ‘buy many, keep one’ culture in which multiple sizes or colours of the same product are purchased with the intent to only keep the most preferred.

Studies show consumers aged 18-24 return 16% of purchases, in contrast to only 7.5% by those over 65 years old. Popular apparel retailer ASOS reported a massive 25% returns rate for UK women’s fashion products.

It’s become a staple of online shopping, especially the apparel sector, to offer customers free returns on their orders. Unlike brick-and-mortar stores, the ability to try on clothes is not available which has led to a ‘buy many, keep one’ culture in which multiple sizes or colours of the same product are purchased with the intent to only keep the most preferred.

Deliveries

Now with online shoppers expectant of a seamless delivery service, it means retailers must ensure their services are competing with the very best. Take Amazon, for example, leading the pack with its next-day Prime service, many retailers are now having to up their offering in order to compete. This can more often than not lead to a logistical nightmare if any part of that delivery service is not up to scratch.

Increasing Fuel Prices

Rising over 70% in just over 12 months, fuel prices have become a serious issue to eCommerce. It leaves retailers with a choice to either absorb the additional delivery costs, push back on delivery partners rising costs or impose on the consumer. Given the high competition of the online market, offloading costs onto the consumer could result in a loss of market share to rivals that decide to swallow costs.

Highly Price Competitive

Price is often the biggest differentiator between eCommerce brands. It is the first thing a consumer will look at when making a purchasing decision, meaning that the market becomes a race to the bottom to see who will offer the best price possible. Online shopping has seen a development of discount codes, vouchers and rewards systems, passing on savings to the customer. Add in price comparison websites, and it becomes more of a battle to directly offer cheaper prices for the same products.

Add in price comparison websites, and it becomes more of a battle to directly offer cheaper prices for the same products, simply to outrank other businesses. The lower a price needs to go, the less revenue the business will be making in the long term.

Acquisition Costs

With millions of people shopping online daily, it’s important to have an acquisition strategy in order to find the right customer for a business and to position themselves above competitors with paid tools. For channels such as Paid search advertising, SEO, Affiliate marketing, Display, Retargeting and Refer-a-friend, these all come at a cost to the retailer and don’t always guarantee results. It’s just as much advertising the business but it doesn’t mean the consumer will make their choice just based on an impression.

In fact, Webloyalty’s ‘Beyond the Core II’ report shows that the cost of acquiring a customer often outweighs the profit made on that customer’s first purchase. This means there is a basis that it is increasingly more important for eCommerce businesses to retain customers in order to turn over a profit. With repeat customers, there is little acquisition spend.

What can eCommerce businesses do to regain margin?

Alternative Revenue Sources

With the rising cost of deliveries, returns and vying for your customer’s attention, it’s important to find alternative sources to generate revenue for your business. Ancillary revenue is a method in which you can create a steady source of bottom-line revenue which can co-exist with your business’ existing profitability strategy. It can also help to mitigate against external economic factors such as cost of living rises.

It’s important to find an ancillary revenue solution that is relatively resilient to external factors. This is essentially where Webloyalty can come in and close that gap. From working with Wowcher, you can see how Webloyalty has successfully helped a business mitigate uncontrollable economic factors and contributed up to 4% of profits. For eCommerce businesses, this is exactly what is needed to counteract the rising expenditures.

Optimising Logistics

Typically, on average, a return order passes through 7 pairs of hands before being relisted for sale. Optimising this process could help eRetailers save significant margin, on cost, time and resources.

Likewise seeking a specialist returns management solution could relieve some of the margin erosion incurred by returned items. An example specialist is ReBOUND, which looks to assist with a myriad of issues during the returns process, ranging from providing insights to more effectively planning returns to the warehouse.

Strategic Discounting

The temptation to offer a discount year-round is large, especially when competitors are offering a lower price for the same product, but it’s also a sure-fire method to devalue your brand and eat your margin. Creating a discounting strategy that is either sporadic or is in response to a specific action such as a reward for a referral is a great way to minimise how much margin you are giving away.

Differentiating Your Customer Offering

Particularly in the last few years, it has been the case that many customers are beginning to focus on the overall experience when engaging with a brand. Keeping customers engaged with your brand increases the probability that those customers will return to your brand and with the amount of spend on acquisition needed to bring in new customers, there is a heightened dependence on retention. Keeping those customers coming back to your business is more essential now than ever before.

What’s the next step?

Ideally, retailers should be using as many different strategies as possible to offset margin erosion but this isn’t always possible, simply due to time and cost. It’s important to start having discussions now to adapt your business strategy in order to not fall behind as revenue fluctuates in the next few years. By 2025, the retailers who come out on top will be the ones who have a process in place to save and even make money, such as ancillary revenues. Now’s the time to make the call and put your plan in place.

Author Bio